If you're paid every two weeks, a biweekly budget and tracking could be perfect for you. It means planning and monitoring how you spend and save money for each paycheck you receive every two weeks.

With a biweekly schedule, you divide up your expenses to match each paycheck. This helps you pay your bills on time and reach your savings goals more easily.

What's the difference between tracking and budgeting

Tracking and budgeting serve different but important purposes.

Tracking means keeping an eye on what you spend and earn, often using apps or spreadsheets.

Budgeting is about setting limits and goals based on your money.

While budgeting helps plan your finances, tracking shows how you actually spend. Budgeting helps you plan your finances, while tracking shows how you actually spend your money. To make a budget work well, it's crucial to know where your money goes. That's why tracking your spending is so important.

Tracking Biweekly Finances using Budget Kanban

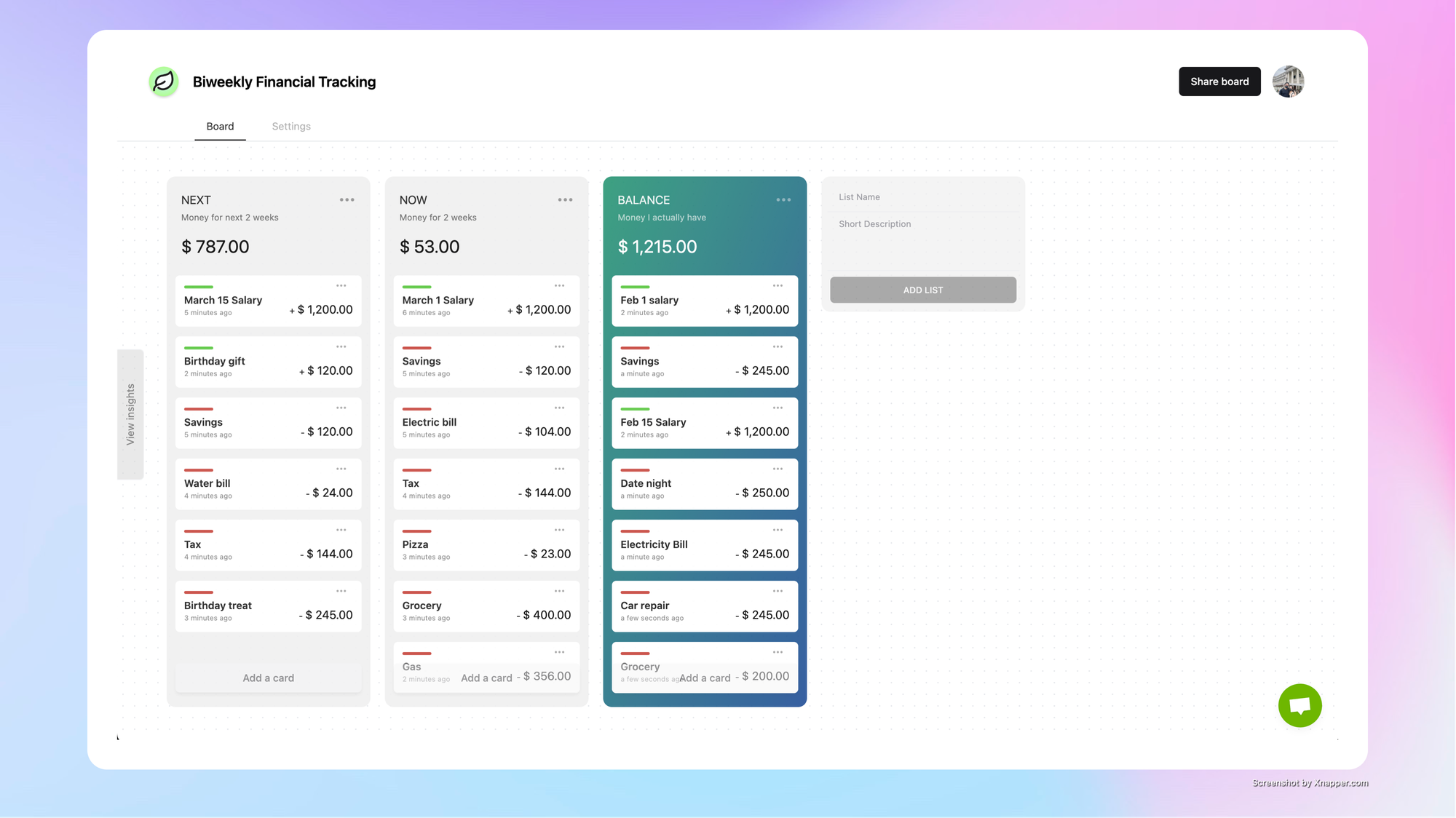

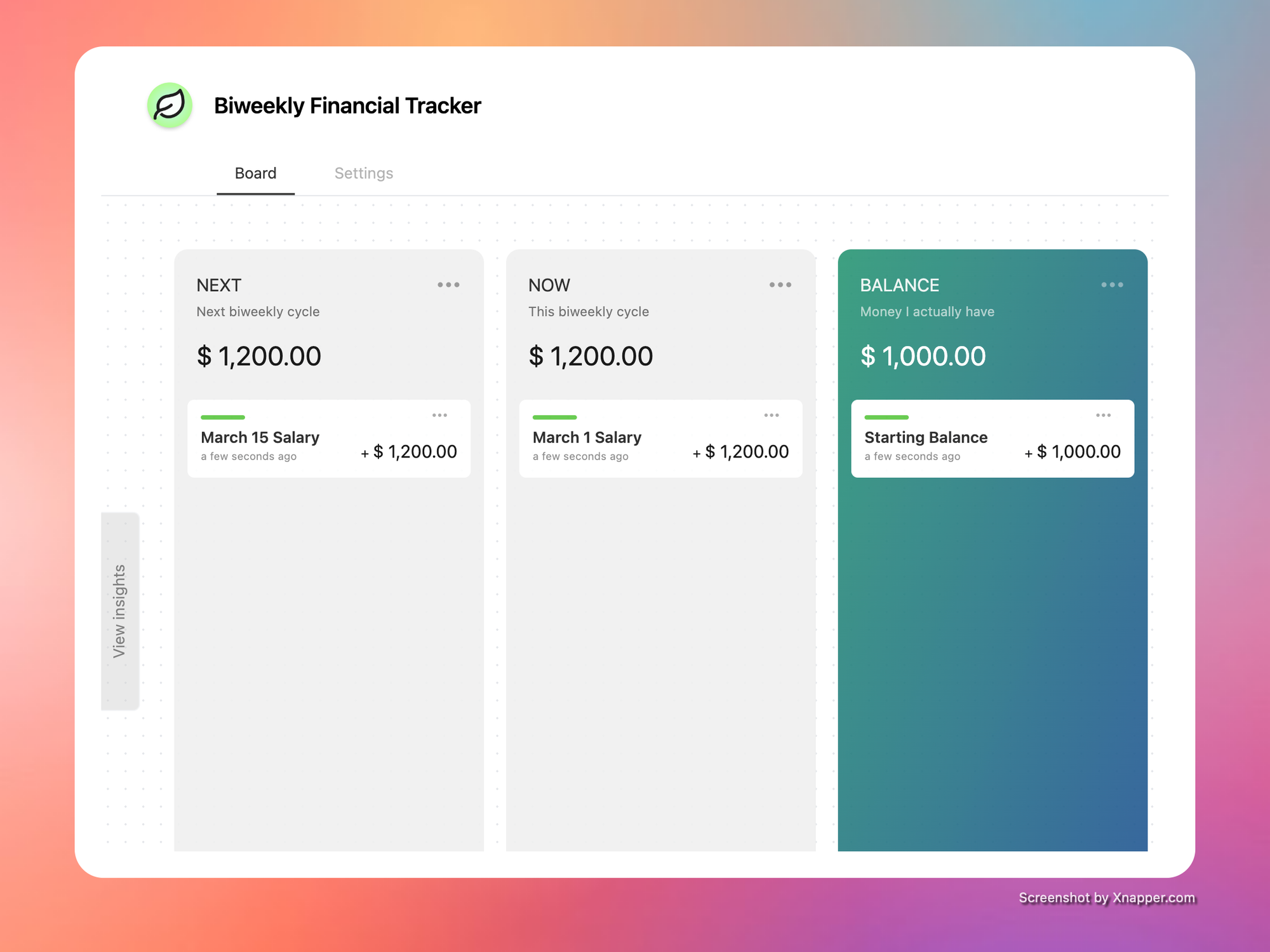

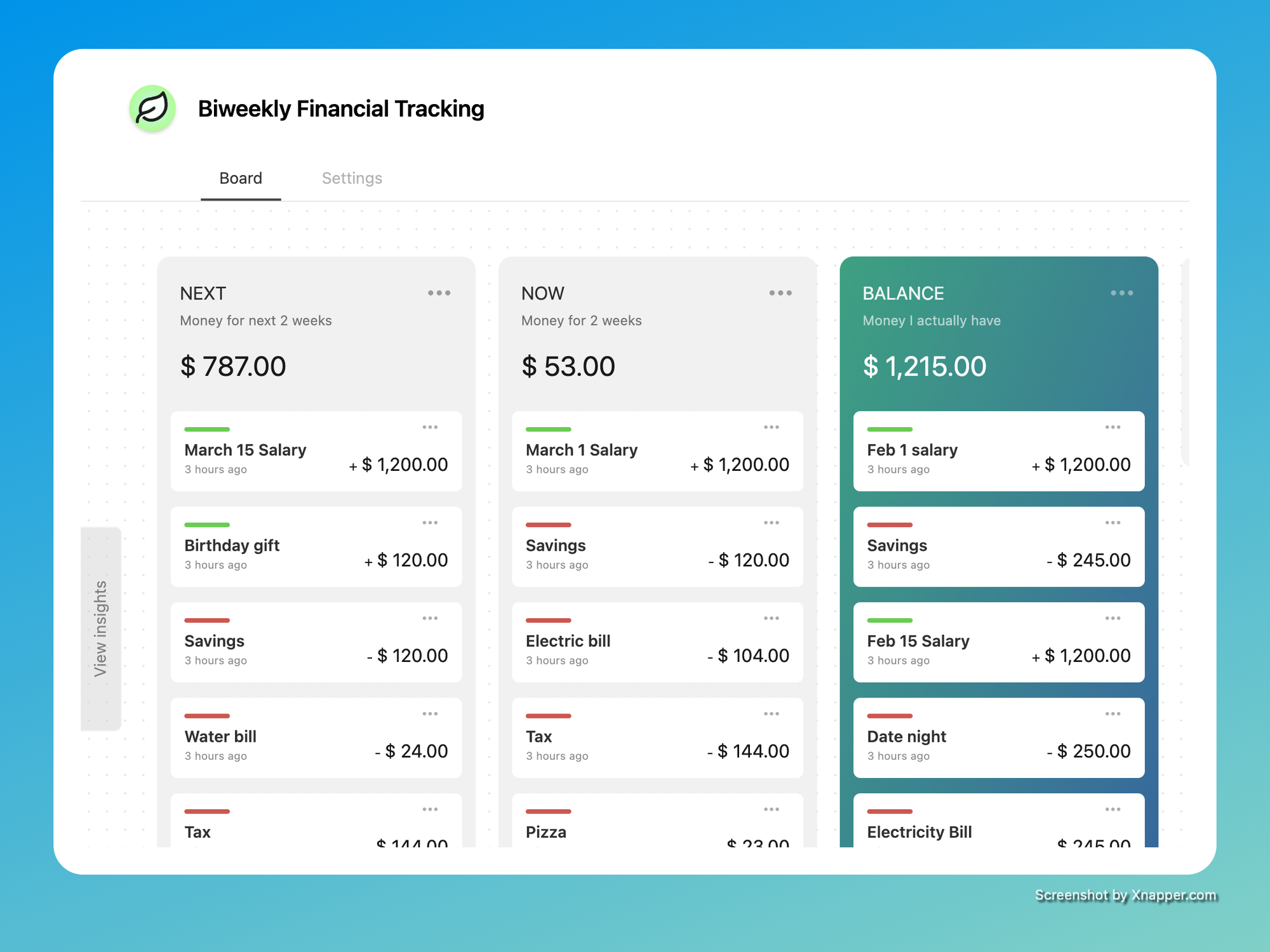

In this post, we'll demonstrate how to simplify financial tracking using Budget Kanban. Budget Kanban is an application based on the Kanban method, designed to assist you in easily monitoring and visualizing your finances. By the end of this guide, you'll have a biweekly financial tracker board resembling the one shown below:

1. Create a new board

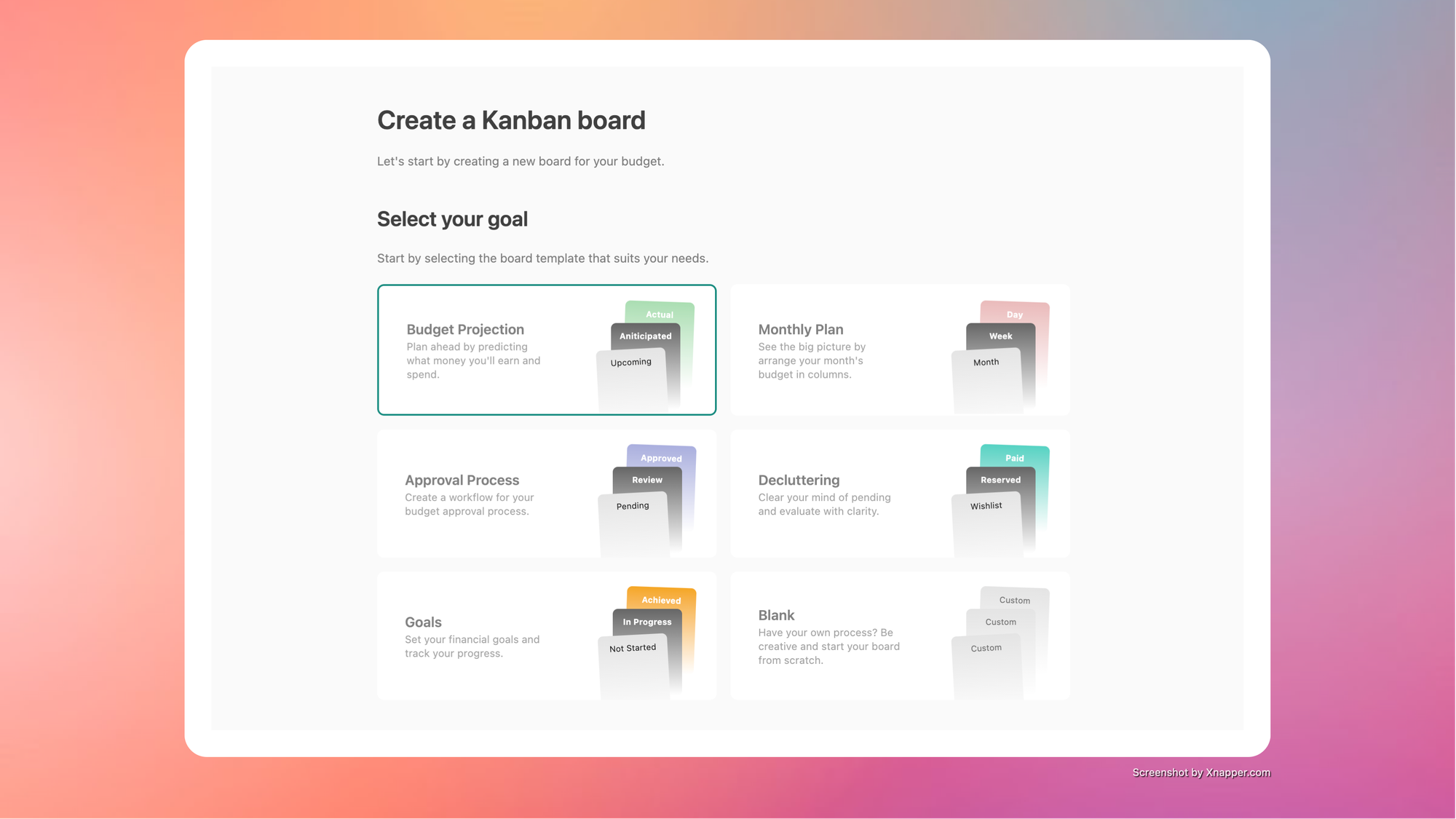

The initial step is to establish a budgeting board. If you haven't already, register for an account at budgetkanban.com. After signing up, generate a new board and title it "Biweekly Financial Tracker."

You'll find various templates designed for different financial objectives. For this tutorial, we'll start from scratch. Select the Blank template and click the "Create Board" button. After a short moment, you'll have a brand-new empty board ready to use.

2. Add 3 columns

We're going to set up three columns on our board, each showing different stages of our budget items. Here's what we'll call them:

- Balance: This column has items that have already been completed. If it's income, it means you've got the money. If it's an expense, it means you've paid it. The total here shows how much money you actually have.

- Now: In this column, you'll place items allocated for the current biweekly cycle that you haven't yet received or paid, but are due soon. For instance, your salary will stay here until it's deposited into your bank account. Similarly, pending expenses will be listed here until they're settled. The sum of this column indicates your pending transactions, offering insight into how you'll allocate your funds or handle debts if it's negative.

- Next: This column contains upcoming items for the following biweekly cycle. While it might seem distant, having this third column aids in planning future expenses within the month. For instance, you might have a significant upcoming expense, and by including it here, you can avoid overspending in the current cycle and prepare for the future. This column streamlines financial strategy without requiring complex formulas or analysis.

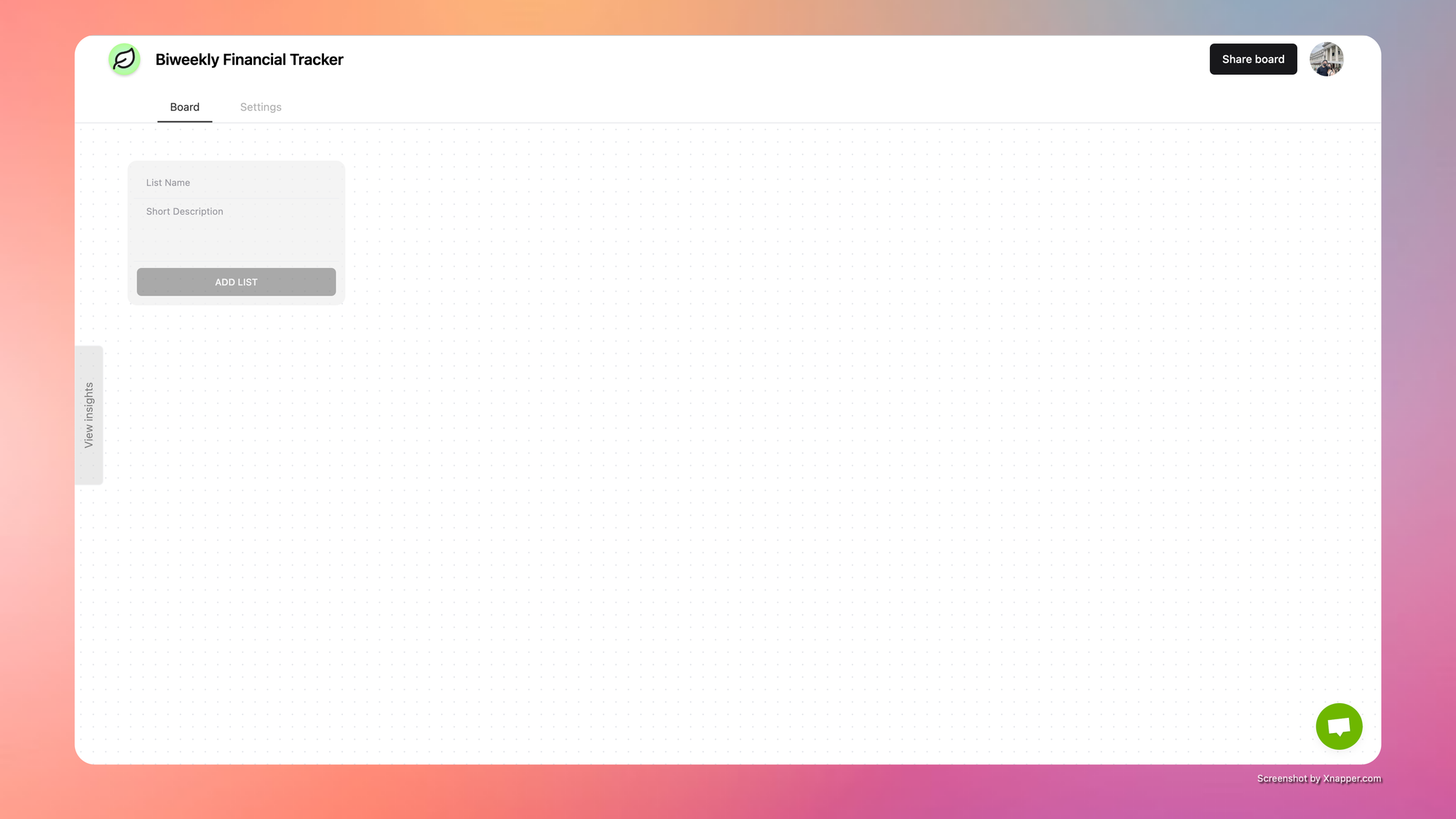

To create a column, you'll see an empty input section prompting you to enter the column name and a brief description.

Let's begin by creating the "Balance" column. This column represents the money you currently possess. After typing "Balance" in the empty input box, provide a brief description such as "Money I actually have," then click the "Add List" button. This action will generate a new empty column labeled "Balance." To further customize it, such as changing the theme color, click the triple dots located in the upper-right corner of the column

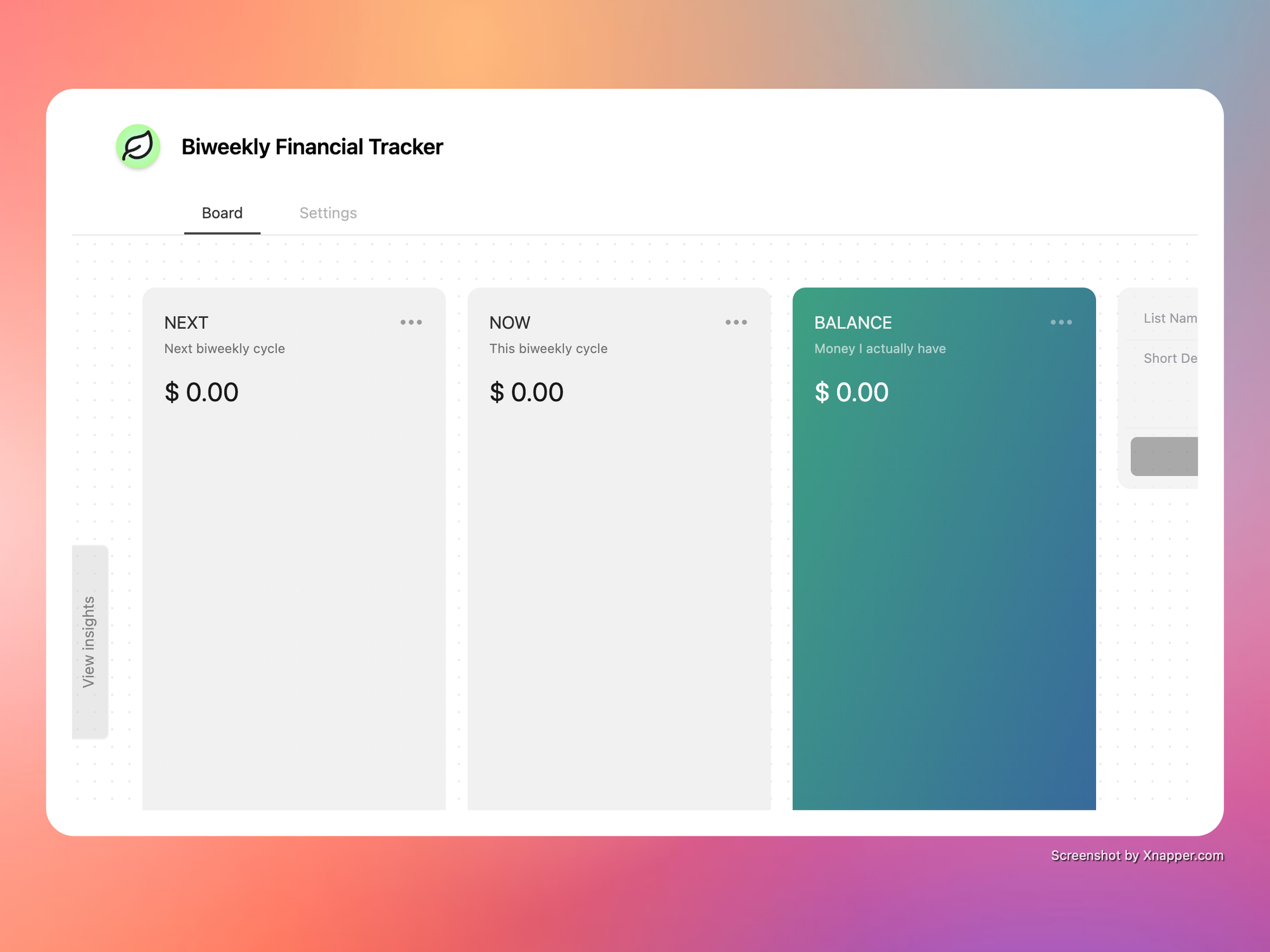

Follow the same steps to create the remaining columns mentioned earlier. Additionally, you have the option to rearrange the columns by simply dragging them to their desired positions. Once you've added all the columns described above, your board should resemble the example provided:

3. Populate your income

Let's put some money on the board by adding your income, like your biweekly salary.

To add your salary, click the "Add Card" button at the bottom of each column. A form will pop up asking for the name and amount of the card. For example, you can put "March 1 Salary" and $1,200 in the **Now** column, and "March 15 Salary" in the Next column.

In the Balance column, just add a card called Starting Balance with the amount of money you currently have.

Once you've added these, your board will start to look like this:

4. Populate your expenses

To complete the board, let's add your expenses. Typically, for each bi-weekly budgeting session, you'd list expenses like:

- Fixed expenses: Rent or mortgage, memberships, loan payments, or subscriptions.

- Groceries

- Clothing

- Entertainment

- Medical bills

- And more.

Decide which part of the biweekly cycle each expense belongs to, then add them to the Now or Next column accordingly.

As you add expenses, notice how the column automatically calculates the total. This gives you instant feedback on how each budget item affects your overall bi-weekly budget.

You can easily move items between columns, which helps you strategize and experiment with your expenses.

Once you've added your expenses, your board will start to look like this:

Movement of finances

Typically, card items move in a linear process from Next to Now to Balance.

When you receive income, move the income card item from Now to Balance. Likewise, when you pay for an expense, move the expense card item from Now to Balance.

At the start of a new budgeting cycle, you move items from Next to Now. At this point, the Now column should ideally be empty. If it's not, it means you might have forgotten to pay an expense or haven't received an income yet.

If you encounter an unexpected expense, Budget Kanban allows you to quickly react to changes in your finances. You can freely add the expense card to Balance or Now, and adjust your financial items by moving cards around.

Inbox column (optional)

When you're busy or have unexpected expenses, you might not have time to organize everything right away. Maybe you suddenly want to buy something, or you have an impulse purchase, or you're just starting to plan a vacation. In these situations, having an Inbox column can be really helpful.

The Inbox column is like a holding area for financial items that you haven't processed yet but might need to deal with later. If you have a new expense idea, just quickly add it to your inbox on the board. Then, when you have time to organize your budget, you can properly allocate it.

You can also use the total of the Inbox column as a signal. If it's growing too much, it might be time to start organizing and processing those items. Otherwise, you can let it keep growing until you're ready to deal with it.

Collaboration

Tracking finances can sometimes involve a group effort. Whether it's with your small team, accountant, family, or spouse, Budget Kanban makes collaboration easy.

To share your board, click the **Share** button in the top-right corner of the app. From there, you can set sharing preferences for your board. Then, copy the link generated and share it with your team. Once they access the link, you can all work together on tracking your finances in real-time.

Conclusion

In conclusion, Budget Kanban makes it simple to track your biweekly finances. Just follow the steps we've covered to create a customized board for managing your income and expenses. Whether you're on your own or working with others, Budget Kanban helps you stay organized and informed about your money. Give it a try and take control of your biweekly budgeting with ease!